How to Amamortize a Loan if You Know the Interest Rate

What is an Amortization Schedule?

An acquittal schedule is a table that provides the details of the periodic payments for an amortizing loan . The master of an amortizing loan is paid downwards over the life of the loan. Typically, an equal amount of payment is made every period.

An amortization schedule can be generated by an amortization computer, with the inputs of the amount, periodic terms, and interest rate of the loan. Through amortization schedules, borrowers tin better plan and rails how much they nevertheless owe and how they volition be repaid.

Summary

- An amortization schedule is a table that provides the periodic payment information for an amortizing loan.

- The loan amount, involvement charge per unit, term to maturity, payment periods, and acquittal method determine what an amortization schedule looks like.

- Amortization methods include the direct line, failing balance, annuity, bullet, balloon, and negative amortization.

Understanding Amortization Schedules

Periodic payments are made for amortizing loans, such as a car or home mortgage. Each payment consists of two components – interest accuse and master repayment . The per centum of interest or principal repayment varies for unlike loans.

The amount of interest charged for each period depends on the predetermined involvement charge per unit and the outstanding rest of the loan. The remaining portion of the periodic payment is applied to repay the master. Only the portion of the principal repayment reduces the remaining loan balance.

With a specified loan amount, the number of payment periods, and the involvement charge per unit, an amortization schedule identifies the total corporeality of the periodic payment, the portions of interest, the principal repayment, and the remaining balance of the loan for every period.

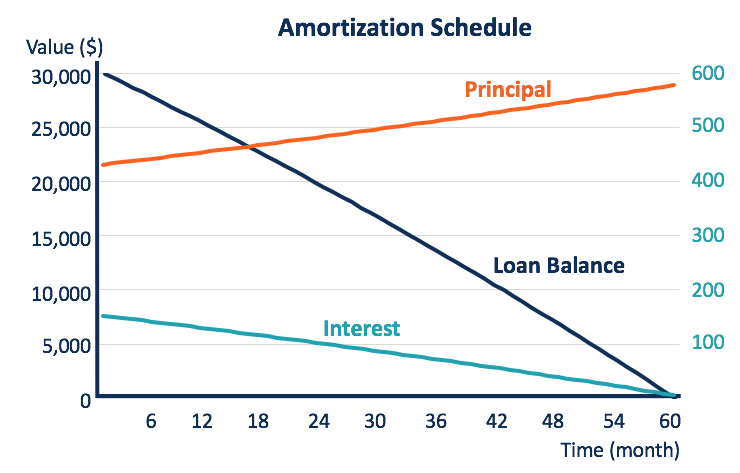

Typically, the remaining residuum of an amortizing loan diminishes as time passes, with principals repaid. Thus, the interest corporeality for each catamenia also decreases over time, and the chief repayment increases gradually.

Example of Acquittal Schedule

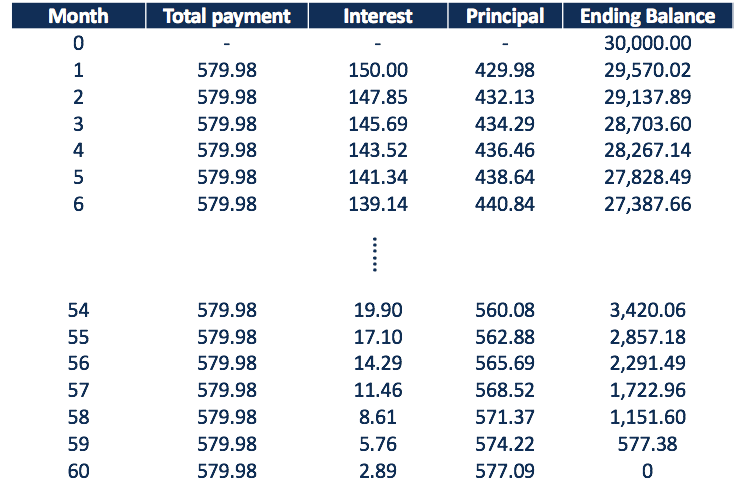

Consider a $30,000 fully amortizing loan with a term of v years and a fixed involvement charge per unit of 6%. Payments are made on a monthly basis. The following tabular array shows the amortization schedule for the first and last six months.

The loan is fully amortized with a stock-still total payment of $579.98 every month. The interest payment for each month can be calculated by multiplying the periodic involvement rate with the ending rest from the concluding month. The remaining portion of the total monthly payment is thus the principal repayment.

In the showtime month, $150 of the total payment is the interest, and $429.98 is the repayment for the principal, which reduces the residue of the loan. As time passes, the interest portion decreases, and greater values of principal are repaid gradually. The rest of the loan, therefore, diminishes at an increasing speed.

Methods for Acquittal Schedule

In that location are multiple methods to amortize a loan. Different methods atomic number 82 to unlike amortization schedules.

1. Directly line

The straight-line amortization, besides known as linear amortization, is where the total interest amount is distributed equally over the life of a loan. It is a commonly used method in accounting due to its simplicity. With stock-still periodic total payment and interest amount, the chief repayment is besides abiding over the life of the loan.

two. Declining rest

The failing-balance method is an accelerated method of amortization where the periodic interest payment declines, simply the principal repayment increases with the age of the loan. In such a method, each periodic payment is greater than the interest charged (interest rate times the showtime loan balance of the menstruum); the remaining part repays the principal, and the loan balance declines. The declining loan balance leads to lower interest charges, and thus accelerates the repayment of the chief.

3. Annuity

A loan amortized in the annuity method comprises a series of payments made between equal time intervals. The payments are as well typically fabricated in equal amounts. In that location are two types of annuity: ordinary annuity, for which payments are made at the end of each catamenia, and annuity due , for which payments are made at the beginning of each period.

Unlike types of annuities can cause a slight difference between their acquittal schedules. The higher the involvement charge per unit or the longer the loan life, the greater the departure. The amortization schedule example in a higher place uses the ordinary annuity method.

4. Bullet

Bullet loans are not typically amortized over the life of loans. Generally, the periodic payments of a bullet loan cover the interest charges merely. It leaves a large amount of the terminal payment at the maturity of the loan, which repays the unabridged principal.

Therefore, the balance outstanding of a bullet loan remains unchanged over the life of the loan and is lowered immediately to cipher at maturity.

5. Airship

A airship loan is like to a bullet loan, which usually repays its entire principal at maturity. Occasionally, information technology is amortized with small amounts of chief repayments, but still leaves the majority paid at maturity. In such a instance, the balance outstanding slightly decreases over the loan life and falls to zero at maturity.

half dozen. Negative amortization

In the negative amortization method, the total payment of a period is lower than the interest charged for that flow. It means that there is nothing left from the periodic payment to repay the principal, and the remaining involvement charge will accumulate to increase the outstanding balance of the loan. The loan balance increases over time and will be repaid at maturity.

More Resource

Thanks for reading CFI'south guide to Amortization Schedule. To keep advancing your career, the additional resources below will exist useful:

- Annual Percentage Rate (APR)

- Loan Construction

- Involvement Expense

- Non-Amortizing Loan

Source: https://corporatefinanceinstitute.com/resources/knowledge/credit/amortization-schedule/

0 Response to "How to Amamortize a Loan if You Know the Interest Rate"

Post a Comment